Subscribe to Updates

Get the latest creative news from Bitcoinsensus.

Get 10% Discount

0.075%

-0.025%

Founded by HDR Global Trading Limited by ex-bankers Arthur Hayes, Samuel Reed, and Ben Delo, BitMEX exchange is a trading platform that has stood out from other exchanges, most notably due to its high trading volumes and dubious history. Indeed, a series of events and scandals surrounding one of the biggest derivatives exchanges have repeatedly called into question its efficacy and trustworthiness in the cryptocurrency and Bitcoin trading space. So, is it safe to trade on BitMEX? Read this full BitMEX review to find out!

Over the years, there has been no small amount of confusion about the controversial exchange. This review will attempt to shed light on the reality of the situation.

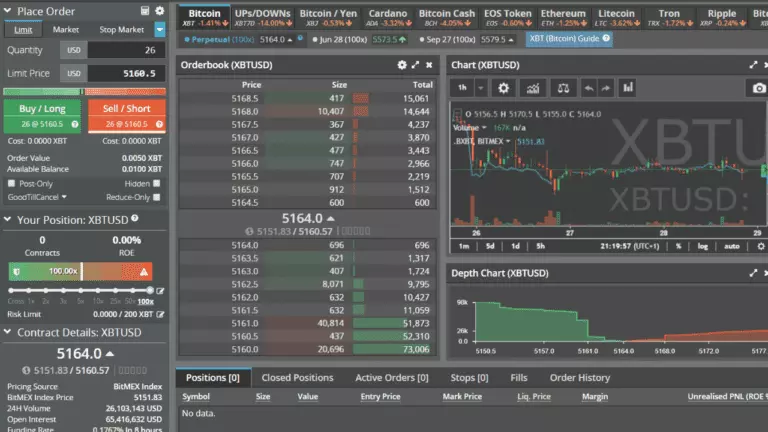

As you may know, BitMEX stands for Bitcoin Mercantile Exchange. BitMEX is a peer-to-peer trading platform that offers leveraged contracts to be bought and sold in bitcoin. Similar to Bybit exchange and Phemex exchange, leveraged contracts are often referred to as derivative and margin trading.

Before delving into more specifics about the platform, it’s important to note that BitMEX has had its fair share of blunders over the years. These issues have cast a shadow over its operations and practices more broadly.

Here are some of the issues that BitMEX has had over the years. Some are worse than others but as a BitMEX trader, it’s important to be aware of them all.

Earlier in the years, back in 2018, rumors about BitMEX giving unfair advantages to certain traders and insiders across the industry began to surface as allegations began piling on. For example, the exchange has been accused on several occasions of engaging in unprofitable trading in order to artificially inflate exchange volumes.

On April 30, a blog post surfaced on the BitMEX blog admitting that the exchange operates its very own for-profit trading arm which was previously not made public. The subsidiary arm trades against customers on BitMEX and while the post states that the business does not have access to any platform order and other details, the market-making arm is run by a BitMEX employee, vaguely referenced as Nick Andrianov.

Nick’s LinkedIn profile pegs him as a BitMEX business development manager, which of course, raises a few eyebrows and brings into question whether the professed boundary between the exchange and its trading arm exists at all.

The blog goes on to discuss how incentives are aligned, stating that earnings are comprised of a service fee paid by the business. So, the BitMEX market maker does not necessarily lose money even in unprofitable trades. This encourages the market maker to (at worst) be an active participant in the exchange which inadvertently and artificially inflates trading volumes at no cost (due to kickbacks).

Apart from being a highly questionable practice, such a blatantly counter-customer market-making activity also raises ethical questions in light of the fact that the blog goes on to say that BitMEX places the interests of its customers first.

Not long ago, BitMEX made headlines again after listing XRP/USD perpetual swaps on the platform, where the asset fell from $0.32 to $0.14 in a single five-minute candle. Some traders claimed that their stop-losses failed to trigger and all their holdings were subsequently liquidated. Since stop-losses failed to execute, many traders lost everything despite having accounted for the possibility of a crash by setting stop orders. This shifts the blame from customers to the exchange.

This is in stark contrast to other exchanges such as Binance, which often refunds their customers in the past due to mistakes or engine failures. Instead, BitMEX released the above statement after the fact.

Back in October 2019, Bitmex made what could arguably be considered a fatal error where it revealed all of its registered users to anyone with an internet connection. The mistake caused a whole furor and drove a heated debate about security in the crypto-verse.

Back in 2019, Bloomberg was revealed that US Commodity Futures Trading Commission (CFTC) launched an investigation against the exchange, ruling that BitMEX was allowing Americans to trade on the platform, which is not a registered US agency. Since the US regulator considers virtual currencies such as bitcoin as a commodity, any exchange onboarding users within its jurisdiction are subject to US rules. As such, BitMEX is now in hot water with US regulators for violating its derivatives trading laws. Check our list of best crypto exchanges in USA.

Having said that, BitMEX is an operational exchange that is still open for all. The team is comprised of several developers, economists, and high-frequency traders, which offer several types of contracts for traders on the platform.

Traditional Contracts or Futures: Traditional futures contract is a derivative product. This means that it’s an agreement to buy or sell a commodity, currency, or other instruments at a prearranged price at a specific time in the future. This is available for BTC and other altcoins.

Perpetual Contracts: A Perpetual Contract is a derivative product that is similar to a traditional Futures Contract. The difference is that there is no expiry or settlement like traditional futures. Perpetual contracts mimic a margin-based spot market and hence trade close to the underlying reference Index Price. This is available only for BTC.

BitMEX Upside Profit Contracts: this allows buyers of the contract to participate in the potential upside of the underlying instrument. This is available only for BTC.

BitMEX Downside Profit Contracts: this allows buyers of the contract to participate in the potential downside of the underlying instrument. This is available only for BTC.

BitMEX gives its traders the opportunity to leverage their position on the platform. Leverage allows users to buy or sell more than the users’ existing balance. This could lead to higher profit or loss in contrast to setting a standard order.

There are two types of Margin Trading: Isolated and Cross-Margin. The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. However, the latter provides that all of the money in the users’ wallets can be used to hold their position, and therefore should be treated with extreme caution.

Bitmex fees are fairly straightforward. The exchange offers up to 100x leverage with the amount of leverage varying from product to product. Of course, trading on high leverage is intended for professional and institutional players familiar with speculative trading and investing.

BitMEX doesn’t charge fees on withdrawals or deposits. However, when withdrawing Bitcoin, the minimum Network fee is allegedly based on the blockchain’s network load. The costs are offset by crypto networks and outside banking fees.

As noted, BitMEX only accepts deposits in Bitcoin, which also serves as collateral on trading contracts. This is regardless of whether or not the trade involves bitcoin.

The minimum deposit is 0.001 BTC and there are no limits on withdrawals, which can also be in bitcoin only.

Supported currencies

On the surface, BitMEX gives the impression of a standard exchange with years of operations behind it. But the ongoing complaints, scandals, clear misconduct, unethical practices, and investigations speak for themselves: BitMEX is a risky exchange with a history that suggests it doesn’t put its users first.

Thankfully, there’s no shortage of cryptocurrency exchange platforms out there. This means that traders can still participate in the Bitcoin derivatives market without taking unnecessary risks. Check out our list of BitMEX alternatives here.

Conveniently buy/sell Bitcoin with EUR

World’s largest crypto exchange

Get Exclusive 50% Deposit Bonus

Get up to $5,000 Welcome Bonus

Get the latest creative news from Bitcoinsensus.

All content on Bitcoinsensus.com is provided for informational purposes, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any product, service or investment. The opinions expressed on Bitcoinsensus does not constitute investment advice and independent financial advice should be sought where appropriate. Trading is a highly risky activity that can lead to major losses, please therefore consult your financial advisor before making any decision. Bitcoinsensus will not be held liable for any of your personal trading or investing decisions. Bitcoinsensus will not be held liable for any losses that you may incur by speculating in the market.