If you’re serious about trading, understanding market structure in trading is a game-changer. It’s the foundation of making sense of price movements, spotting trends, and making better decisions. In this guide, we’ll break down what market structure is, how to spot key patterns, and how to use this knowledge to improve your trades. Whether you’re a beginner or an experienced trader, these insights will help you make smarter moves in the market.

1. Identifying the Directional Trend

The first step to understanding market structure in trading is recognizing the direction of the market. The market generally moves in three ways:

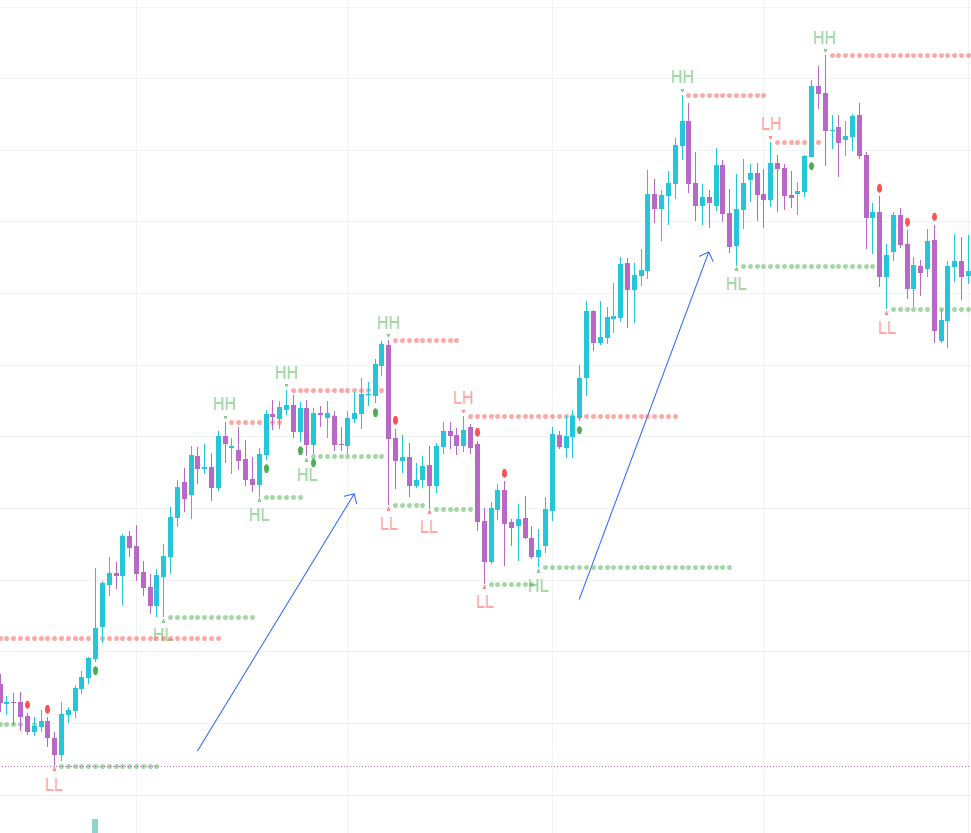

- Uptrend: This is when the market keeps making higher highs (HH) and higher lows (HL). When you see this, it usually means there’s bullish momentum, and it might be a good time to buy.

- Downtrend: Here, the market is making lower highs (LH) and lower lows (LL). This is a sign that the market could be moving down, and traders might look to sell or short the market.

- Consolidation: Sometimes, the market moves sideways in a range. This phase can feel boring, but it’s actually a crucial phase. It often comes before a breakout—either up or down—so it’s a good idea to pay attention to these moments.

Recognizing these trends will help you determine when to enter or exit a trade. If you’re curious about how to analyze market structure for better trades, it’s essential to understand the directional trends in the market.

2. Order Blocks (OBs): What Are They and Why Do They Matter?

Let’s talk about order blocks (OBs)—a key concept when it comes to understanding market structure. An order block is simply a price zone where institutional traders have placed big buy or sell orders. These areas act like magnets for price movement.

- Bullish OBs: These are found when the price breaks above a previous high, suggesting the market could continue to rise. Traders often look for these zones as potential support areas.

- Bearish OBs: These form when the price breaks below a previous low, acting as resistance. If the price returns to this level, it might be a sign to sell.

Order blocks help you pinpoint important levels where the price could reverse, and they play a big role in market structure psychology and trader behavior, especially when institutional traders step in.

3. Consolidation and Accumulation: What’s Going On?

You might come across a phase where the market doesn’t seem to be going anywhere. This is called consolidation, and it can be tricky because it feels like nothing is happening. But consolidation often happens right before the price breaks out, either up or down. It’s the market taking a breather before making a big move.

Accumulation happens during a downtrend when price action slows down and becomes range-bound. This is often a sign that bigger players in the market (like institutional investors) are starting to pick up assets at lower prices. If you spot this early, it can be an excellent chance to get in before a potential price increase. Traders also consider accumulation as part of the types of market structures, indicating the groundwork for a potential uptrend.

4. Divergence: A Hint for Trend Reversals

Divergence is a signal that can point to a potential trend reversal. This happens when price action and your indicators (like RSI or MACD) don’t agree with each other.

- Bullish Divergence: This occurs when the price makes lower lows, but your indicator makes higher lows. It’s like the market is telling you that the downward trend might be losing steam, and an upward reversal could be coming.

- Bearish Divergence: When the price makes higher highs but the indicator makes lower highs, it suggests that the market might be running out of steam and could reverse downward.

Watching for divergences can give you a heads-up when the market is about to change direction. It’s one of the key elements of analyzing market structure vs price action: key differences that can influence your trading decisions.

5. Advanced Trading Strategies Based on Market Structure

Once you’ve got the hang of identifying trends, you can start adding some more advanced tools to your toolkit:

- Fibonacci Retracements: Fibonacci levels are popular for spotting potential reversal points. If you see the price retracing to a key Fibonacci level, it might be a good spot to enter the market.

- Candlestick Patterns: Candlesticks aren’t just pretty to look at—they’re great indicators of market sentiment. Patterns like bullish engulfing or morning star can tell you when the market is likely to shift.

- Support and Resistance: These are key levels where the price tends to bounce off or break through. Understanding where these levels are can help you time your trades better. This aligns with the role of support and resistance in market structure, helping you find the most crucial price levels.

6. The Psychology Behind Market Structure

The way traders think and feel often shapes market movements. Market sentiment—the collective mood of all participants—can drive price action. When the market is feeling fearful, it can lead to sudden drops, while periods of greed can fuel rallies.

It’s also important to have emotional discipline. The market can be volatile, and it’s easy to get caught up in the excitement or panic. But successful traders know how to stay calm and stick to their trading plan, even when the market feels unpredictable.

If you’re looking at how institutional traders use market structure, understanding their psychology and behavior is a good start. These larger players often move the market in significant ways, and their actions can give you clues on how to position your trades.

7. Risk Management: Protect Your Investments

No matter how skilled you are, risk management is key. If you don’t have a plan for managing risk, one bad trade could wipe out your profits. Here’s how you can protect yourself:

- Stop-Loss and Take-Profit Orders: These tools automatically close your positions at a certain price level, helping you lock in profits or cut your losses before they get out of hand.

- Position Sizing: This is about managing how much you risk on each trade. By ensuring you don’t risk too much on a single trade, you can protect your capital and keep trading for the long term.

8. Stay Informed: Regulations and Compliance

Before you dive into the market, it’s important to know the legal rules in your country. Each country has its own regulations around trading, taxes, and compliance. Make sure you’re staying on top of these so that you don’t run into legal issues down the road.

9. Tech Tools to Help You Trade Smarter

There are tons of tools out there to help you analyze and trade more effectively. Platforms like MetaTrader and TradingView are popular choices for charting and analyzing price data. You can use them to track market structure and spot trends in real-time.

Automated trading bots can also be a useful tool. These bots can help you execute trades based on specific criteria, eliminating emotional decision-making and making sure your strategy is always followed.

10. Keep Learning and Evolving

The markets are always changing, and so should your approach to trading. Keep learning new strategies, testing different approaches, and adapting to the ever-evolving market conditions. This is the best way to stay ahead of the curve.

A great way to stay up-to-date and improve your trading skills is by joining the Legends Community. In our community, we share detailed market analysis, trading setups, and up-to-date information that will help you make more informed decisions. Not only will you gain insights into current market trends, but you’ll also learn more about the structure of the market, giving you a deeper understanding of how to trade successfully.

Conclusion

Understanding market structure in trading isn’t something you learn overnight—it takes time and practice. But by recognizing key trends, spotting order blocks, and staying disciplined, you’ll have the tools you need to make better trading decisions. The market is full of opportunities, and by understanding the structure behind it, you can put yourself in a position to take advantage of them.

If you’re looking for more tips on market analysis or trading strategies, be sure to check out our other articles at Bitcoinsensus. Whether you’re looking to understand market structure vs price action or dive into trading strategies based on market structure, we’ve got you covered!