Table of Contents

Overview

Discover the ins and outs of Bybit futures trading with our comprehensive guide. This article is designed to provide new traders with a clear understanding of the key elements involved in trading futures on the Bybit platform. From leveraging opportunities and contract types to trading fees and risk management techniques, this guide equips readers with the essential knowledge needed to excel in Bybit futures trading.

Bybit Cryptocurrency Exchange

Bybit is a leading cryptocurrency exchange platform that aims to provide a premium trading experience to its users. Founded in 2018 by a team of experts with backgrounds in investment banking and the forex industry, Bybit has quickly gained popularity as an innovative and fast-growing derivatives exchange. Headquartered in United Arab Emirates and registered in the British Virgin Islands, Bybit envisions a global economy and offers a fast, secure, and transparent trading system. With a strong focus on user experience, Bybit caters to both retail and professional clients, serving over 10 million users worldwide. Bybit’s commitment to innovation and advanced blockchain technology positions it as a key player in building the next-generation financial ecosystem.

Unleash the potential of leverage trading! Join Bybit today with our link, complete KYC, and earn up to a $40 bonus on a $100 deposit. Don’t miss out on this exclusive offer; claim your bonus now!

What is Futures Trading?

Futures trading involves trading contracts that derive their value from underlying assets, focusing solely on their price movements rather than the assets themselves. This makes futures contracts more flexible and easier to manage. They also enable margin trading with high leverage. Futures contracts are a type of derivative instrument, along with Contracts for Difference (CFDs), Options, and Swaps. Originally designed for commodities like food, oil, and metals, futures contracts have expanded to encompass all financial markets, including cryptocurrencies. These contracts allow traders to speculate on the future price movement of an asset.

For instance, if you anticipate a rise in Bitcoin’s price, you can open a long position by purchasing a Bitcoin futures contract with a monthly expiry date. Alternatively, if you expect a decline, you can go short. At the contract’s expiry date, the involved parties settle the trade, closing the contract. While most futures contracts have an expiry date, perpetual contracts, a subcategory of cryptocurrency futures, do not expire. They behave similarly to traditional futures but lack an expiration and settlement.

Perpetual contracts closely track the spot price of the cryptocurrency, and their pricing relies on the funding rate, which entails regular payments between long and short positions based on market conditions.

Standard Futures Contracts

Standard futures contracts in the cryptocurrency market closely resemble traditional futures contracts, including expiry and settlement. CME Group and CBOE exchanges were pioneers in introducing Bitcoin futures contracts in December 2017. The launch of these contracts contributed to a significant surge in Bitcoin’s price, leading to a new record high. CME continues to offer various Bitcoin futures with different expiry dates, settling in U.S. dollars upon expiration. While CBOE temporarily discontinued its Bitcoin futures contracts, the growing interest in cryptocurrencies suggests their potential return.

Also, several crypto exchanges, such as Bybit, and Binance, offer standard futures contracts. These contracts, typically dealing with quarterly Bitcoin futures, are settled every three months and are particularly suitable for swing trading.

Perpetual Contracts

Perpetual contracts are a popular type of cryptocurrency futures that don’t have an expiration date. They gained popularity on platforms like BitMEX and are now offered by major exchanges such as Bybit and Binance. Perpetual contracts closely track the spot price through a mechanism called funding, where traders pay or receive payments based on the price difference. Bybit, for example, settles funding every eight hours in USDT and other stablecoins. Despite market fluctuations, perpetual futures have shown resilience, with average volumes ranging from $50 billion to $200 billion. This dynamic market presents significant potential and intense competition among top exchanges and decentralized platforms.

Bybit Futures Liquidity

Bybit stands out as a platform with remarkable liquidity compared to its counterparts. Liquidity is a crucial factor as it indicates the platform’s ability to swiftly convert futures and other financial products into cash whenever needed. Here is how Bybit’s liquidity compares to other platforms on a daily basis.

- Bybit: $6,491,489,707

- Binance: $31,809,897,845

- KuCoin: $1,582,203,613

- Bitget: $5,894,207,420

Bybit holds an impressive position as the third-ranked platform globally in terms of 24-hour trading volume for derivatives. This notable ranking solidifies its standing as one of the leading crypto futures trading platforms worldwide.

Bybit Futures Leverage

Bybit, one of the top crypto futures trading platforms globally, offers a range of features for traders to consider. Leverage is a crucial aspect, allowing users to adjust the margin rate for their positions. With Bybit, leverage acts as a way to modify the initial margin rate used in trading. Higher leverage means less margin is required, enabling traders to open larger-sized positions and potentially increase profits while keeping the same margin amount.

However, it’s important to note that higher leverage also increases the risk of liquidation, as the position can be more easily liquidated if losses accumulate. Conversely, lower leverage requires more margin, limiting the size of positions that can be opened. While this reduces the risk of liquidation, it also decreases the potential for substantial gains.

Bybit offers a maximum leverage of 100x on Bitcoin and 50x on other currencies, providing users with flexibility in their trading strategies.

Bybit Futures Trading Fee

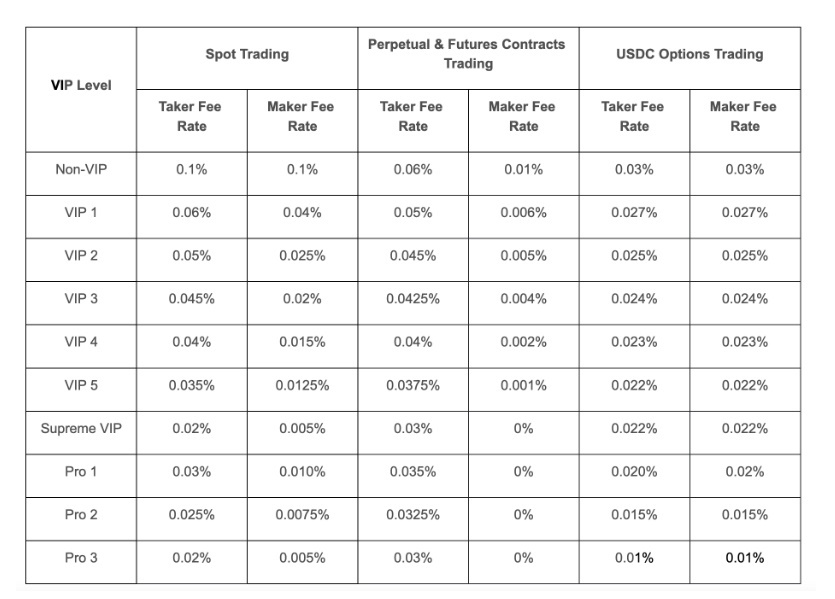

Bybit is one of the most affordable future trading platforms out there. The fee structure for trading spot, and derivatives on Bybit is as follow:

How to Trade Bitcoin Futures on Bybit

You can trade Bitcoin futures on Bybit by following these simple steps.

Create Your Bybit Account

To get started with Bybit, simply visit Bybit.com and create your account. The process begins by providing your email address and setting up a password. If you wish to unlock additional features, you have the option to complete KYC (Know Your Customer) verification by providing your personal information. By completing KYC, you can access enhanced functionalities on the platform. As a treat, you can use our special link during signup to earn a bonus for joining.

Deposit Funds into Your Account

After signing up, you will be directed to the main dashboard where you can click on the “Deposit” option to add funds to your Bybit account. Before proceeding, you will need to complete the Level 1 identification process by providing the required personal information to Bybit. Once the identification process is done, you can deposit funds by transferring them from another wallet or by making a direct purchase on the Bybit platform. Alternatively, you have the option to use the P2P trading method to add funds to your account.

Go to USDT Perpetual Contracts

After successfully depositing funds, navigate to the derivatives tab at the top of the screen and select the USDT Perpetual contracts. This will redirect you to the trading interface specifically designed for Perpetual contracts. From there, you can begin trading. If you wish to switch between different cryptocurrencies, simply click on the BTC/USDT option located in the top left corner to select your desired trading pair.

Choose Your Leverage

Now comes the decision of whether you want to take a long (buy) or short (sell) position on Bitcoin, along with selecting an appropriate leverage level. It is recommended to exercise caution and opt for lower leverage, as higher leverage entails greater risk. With higher leverage, the liquidation price becomes tighter, and even a small price movement can result in the loss of your entire balance. It’s essential to choose a leverage level that balances risk and potential reward, ensuring it aligns with your risk tolerance and trading strategy. The option for adjusting leverage is located at the top right in the last box.

Now Place Your Order Value

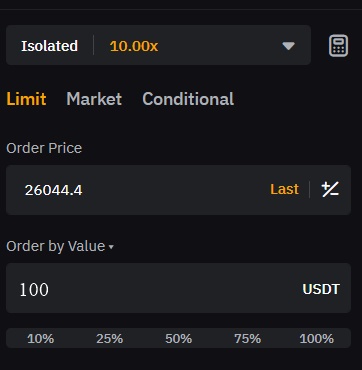

After determining the leverage, the next step is to set the limit price at which you wish to make a purchase. Additionally, you need to specify the order value in USDT. For instance, if you intend to buy BTC at $26,044 with an order value of $100, here’s an example of how it would appear:

Add Take Profit and Stop Less and Execute Your Trade

Once you have entered the trade values, you can click on the TP/SL (Take Profit/Stop Loss) option below to set your desired stop loss and take profit levels in advance. This step is crucial as it allows you to automate the trade and effectively manage your potential losses. After inputting the values, you can then proceed by clicking on either “Buy Long” or “Sell Short” depending on whether you are initiating a long or short position.

Conclusion:

In conclusion, Bybit Futures Trading offers a comprehensive platform for traders seeking to engage in cryptocurrency futures trading. With its user-friendly interface, diverse range of features, and robust liquidity, Bybit has positioned itself as one of the top crypto futures trading platforms worldwide. Bybit’s leverage options provide flexibility for traders, allowing them to adjust their margin rates and optimize their trading strategies. Additionally, the platform offers Perpetual contracts and standard futures contracts, catering to the preferences of different traders. Bybit’s commitment to security and customer satisfaction, along with its competitive fees and extensive customer support, further enhance the overall trading experience.

You also like the following:

How to Trade Bitcoin (BTC)?

To understand the basics of Bitcoin trading, you can read our How To Trade Bitcoin Guide. It can prove helpful for traders who are just getting started with Bitcoin trading. You can also check out our list of top Bitcoin Exchanges To Trade With.