Table of Contents

Introduction

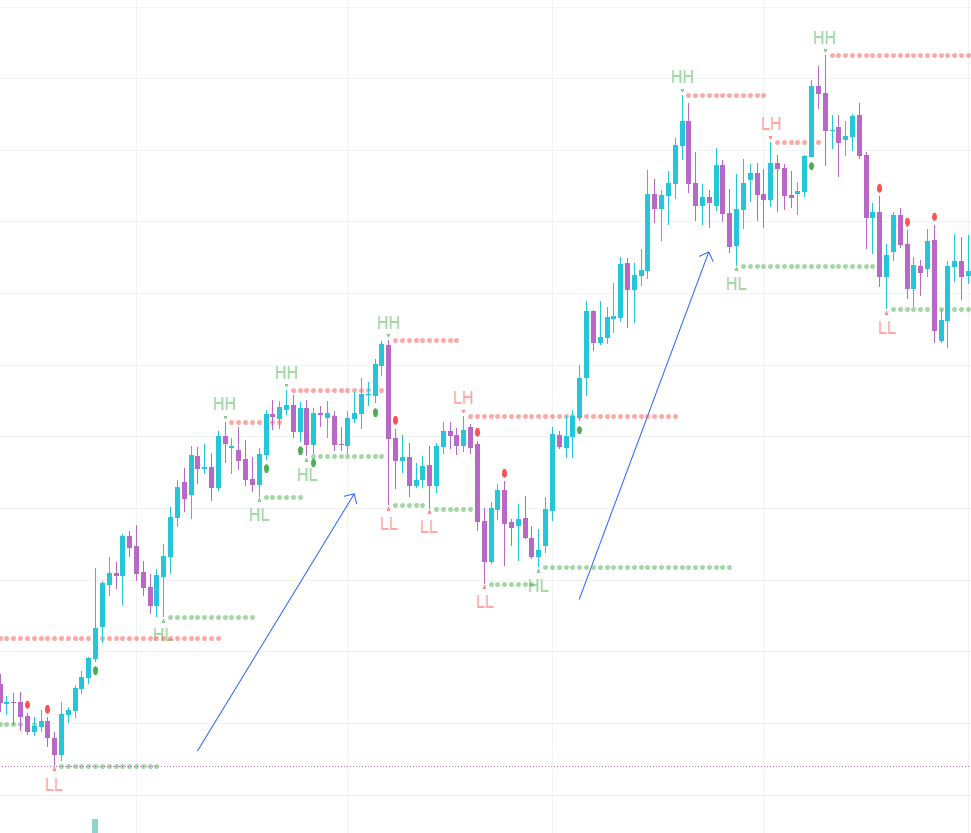

An understanding of market structure is crucial for investors and traders. It provides a lens through which market trends can be analyzed, and predictions made about future price movements. This comprehensive guide offers detailed insights into market trends, order blocks, consolidations, divergences, and more.

1. Identifying the Directional Trend

A market’s directional trend can be broken down into:

- Uptrend: Recognized by higher highs (HH) and higher lows (HL), indicating bullish momentum.

- Downtrend: Defined by lower highs (LH) and lower lows (LL), signaling bearish momentum.

- Consolidation: A neutral phase where the price moves sideways.

2. Order Blocks (OBs)

Order Blocks are essential in trend identification:

- Bullish OBs: Spotted when a high breaks the past high before a shift in market structure. They act as support zones.

- Bearish OBs: Considered resistance zones.

3. Consolidation and Accumulation

- Consolidation: Often mistaken for a trend, it’s a phase of indecision that may lead to an upward or downward breakout.

- Accumulation: A subset of consolidation, typically characterized by a lack of market enthusiasm after a significant downward push.

4. Divergence

A crucial signal for potential trend reversals:

- Bullish Divergence: Suggests a move from a downward trend.

- Bearish Divergence: Indicates a potential move from an upward trend.

5. Advanced Trading Strategies

- Fibonacci Retracements: Used to identify potential reversal levels.

- Candlestick Patterns: These can provide insights into market sentiment and potential reversals.

- Support and Resistance Trading: Trading based on crucial support and resistance levels.

6. Psychological Factors

- Market Sentiment: Understanding how mass psychology moves prices.

- Emotional Discipline: Keeping emotions in check is crucial for maintaining a consistent trading strategy.

7. Risk Management

- Stop-Loss and Take-Profit Orders: Protect investments from unexpected market shifts.

- Position Sizing: Using appropriate leverage to ensure sustainable trading.

8. Regulatory Considerations

Understanding local regulations, taxes, and compliance requirements is vital for lawful and successful trading.

9. Technological Tools

Various software and platforms can enhance analysis and execution, such as MetaTrader or TradingView.

10. Continuous Education

Markets are ever-changing, and continual learning and adaptation are necessary for sustained success.

Conclusion

The understanding of market structure is not just a skill but an art that requires patience, discipline, and a willingness to learn. From recognizing the fundamental trends to implementing advanced strategies, this guide offers a foundational understanding of navigating the financial markets. By blending technical analysis with psychological insights and risk management principles, traders and investors can build a robust and adaptable approach to achieving success in the complex world of financial trading. Whether a hobbyist trader or a professional fund manager, the insights gained from understanding market structure can provide a critical edge in the competitive investing world.