Table of Contents

Overcoming the Challenges Post-FTX Collapse

- Kaiko reports a significant recovery in crypto market liquidity, bridging the “Alameda Gap” created post-FTX collapse.

- Bitcoin’s recent price surge plays a key role in increasing market depth and stabilizing trading conditions.

- Improved liquidity conditions are reflected in narrower BTC/USD spreads across major U.S. exchanges.

Crypto market analysts have recently reported a significant recovery in the cryptocurrency market’s liquidity, specifically overcoming a challenge known as the “Alameda Gap.” This development marks a noteworthy turnaround since the notable decline following the collapse of FTX and Alameda Research in November 2022.

Unleash the potential of leverage trading! Join Bybit today with our link, complete KYC, and earn up to a $40 bonus on a $100 deposit. Don’t miss out on this exclusive offer; claim your bonus now!

Closing the “Alameda Gap”, A Turnaround in Crypto Liquidity

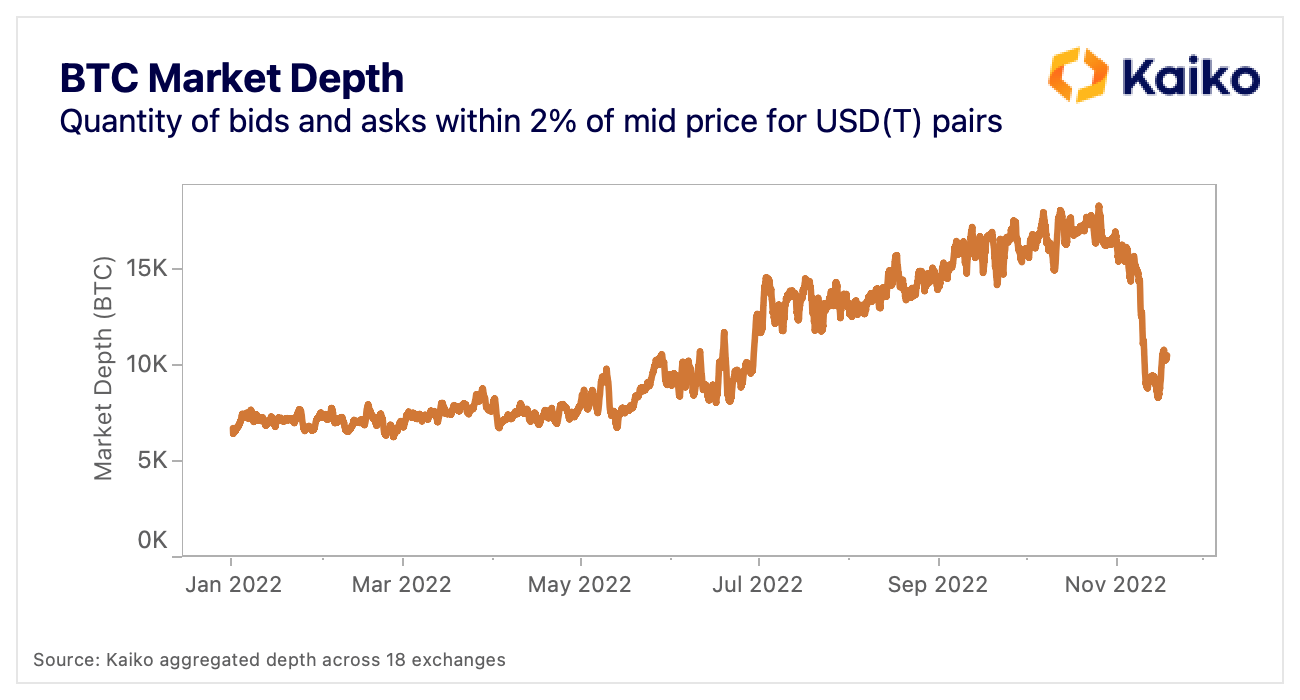

Kaiko, a leading crypto research firm, has observed that the liquidity in the crypto market has almost returned to the levels seen before the FTX fallout. The term “Alameda Gap,” coined by Kaiko in November 2022, referred to a notable decrease in liquidity on global exchanges after significant losses by major market makers like Alameda Research. The decline had significantly impacted trading volumes and market stability, underlining the critical role of large players in the cryptocurrency markets.

For over a year, market makers maintained a cautious stance, resulting in the persistence of this liquidity gap. However, Kaiko’s recent bulletin on March 18 highlights a significant shift. The firm reports that Bitcoin’s 2% market depth has increased by 40% since the beginning of the year, briefly surpassing its pre-FTX average of $470 million.

Unleash the potential of leverage trading! Join Bybit today with our link, complete KYC, and earn up to a $40 bonus on a $100 deposit. Don’t miss out on this exclusive offer; claim your bonus now!

Bitcoin’s Rally Serves as a Catalyst for Market Recovery

This recovery aligns with the recent surge in Bitcoin prices, which have seen a 60% increase since the start of the year, reaching a new high of $73,750 on March 14. Such an upward trend in Bitcoin prices has played a crucial role in bridging the liquidity gap.

Furthermore, Kaiko also reports a narrowing of BTC/USD spreads on major exchanges in the United States, including Coinbase, Kraken, and Bitstamp. A spread refers to the difference between the asking and bidding prices of an asset. This reduction in spreads indicates significantly improved liquidity conditions in the market, making trading in the U.S. notably cheaper. This change, according to Kaiko, could be partly attributed to structural reasons in the market.

Narrowing Spreads Signal Enhanced Liquidity

Despite the optimism surrounding the market’s liquidity recovery, there were concerns earlier this month about a potential “sell-side liquidity crisis” in Bitcoin. Cointelegraph had reported that such a crisis might arise if the inflows into institutional exchange-traded funds (ETFs) continued at a high rate. However, recent trends have shown a slowdown in daily ETF inflows, which have dropped significantly from their previous highs.

In summary, the latest data from Kaiko provides a positive outlook for the cryptocurrency market, suggesting that the adverse effects of the “Alameda Gap” are no longer a significant concern. The recovery in market liquidity, coupled with the surge in Bitcoin prices, indicates a healthier and more stable market environment. As the cryptocurrency market continues to evolve, these developments underscore the resilience and adaptability of this dynamic financial sector.

Enhance Your Crypto Trading Skills With Our Legends’ Trading Masterclass

Empower your crypto trading skills with our Legends Masterclass. Sign up now and take advantage of our limited-time discount offer! Join the class today.