Table of Contents

The number one digital asset has been through thick and thin this past decade, and despite all odds has prevailed over calls for its imminent demise time and again. And everyone wants to know, what’s the Bitcoin price prediction for 2020?

In fact, not only has bitcoin risen in spectacular fashion over the years – recording over a 9,000,000% price increase since its inception, but many expect the number one digital currency to surpass all time highs possibly even within 2020.

Indeed, the question about bitcoin’s price trajectory in the next couple of months to years is the trillion-dollar question, and many experts have put both their reputation and cash on the line in anticipation of the elusive end-game of bitcoin mass adoption.

However, for the purposes of this write-up, we’ll focus on the not too distant future.

Now that the second quarter of 2020 is already over and done with, the possibilities for a major rally past $20,000 in the second half of the year is a prospect many in the crypto space have to contend with (since historically, bitcoin has experienced great price-action at the end of the year).

In order to delve into this correctly, we have to ask a few questions.

What happened in the first half of 2020?

Following last year’s December doldrums, where bitcoin declined around 54% from $14,000 highs to $6,400 lows, the number one digital asset managed to find reinvigorated support at the turn of the decade. Just before the breakout in January, bitcoin formed an ‘inverse head and shoulders’ or a ‘triple bottom’ technical pattern, which shifted its trajectory to the upside with a 64% gain in just 2 months.

If you were following the space at the time, you’ll remember that bitcoin sentiment was incredibly bullish all the throughout the corrective upward move, which ultimately saw bitcoin topping out at around $10,400 – just under $10,500 mark.

In mid-February, news of the corona-virus began circulating the airwaves and the situation quickly became dire, especially when one considers that bitcoin was arguably already due for a correction from a technical perspective. In fact, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) were signalling a potential shift in momentum on the higher, daily time-frame. This culminated in a major sell-off that saw bitcoin drop down to $3,800 on what is now commonly referred to as black Thursday.

Of course, several other reasons contributed to the price-decline, namely the expiration of options contracts, a lack of liquidity on exchanges as well as some technical issues with Bitmex and other exchanges, which had to forcibly halt trading during the monumental price drop.

Where is bitcoin today?

Today’s picture is completely different both from a technical and fundamental point of view. In fact, after having bottomed out at $3,800, bitcoin rallied 170% in four months – testing the $10,400 level once again just recently.

Do the fundamentals support a 2020 rally past all-time-highs?

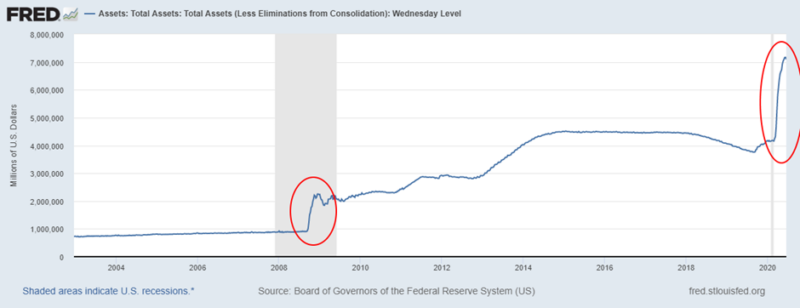

During this run-up, a number of macro-economic factors were well underway in global economies, namely central bank stimulus packages and bailouts numbering in the trillions of dollars. The scope and scale of the actions from central bankers like the Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England (BoE) the Bank of Japan (BoJ), and the People’s Bank of China (PBOC), was something never before seen in the history of governments and central banking.

Case in point, the Fed’s money printing actions in 2020 dwarfed what was done during the 2008 financial crisis by orders of magnitude, amplifying the narrative for a currency that cannot be debased in the process.

To be more specific, the narrative for scarce currencies such as bitcoin and scarce physical commodities like gold became stronger than ever, with hedge fund industry leaders like Ray Dalio and Paul Tudor Jones anticipating an eventual decline in the Dollar’s purchasing power.

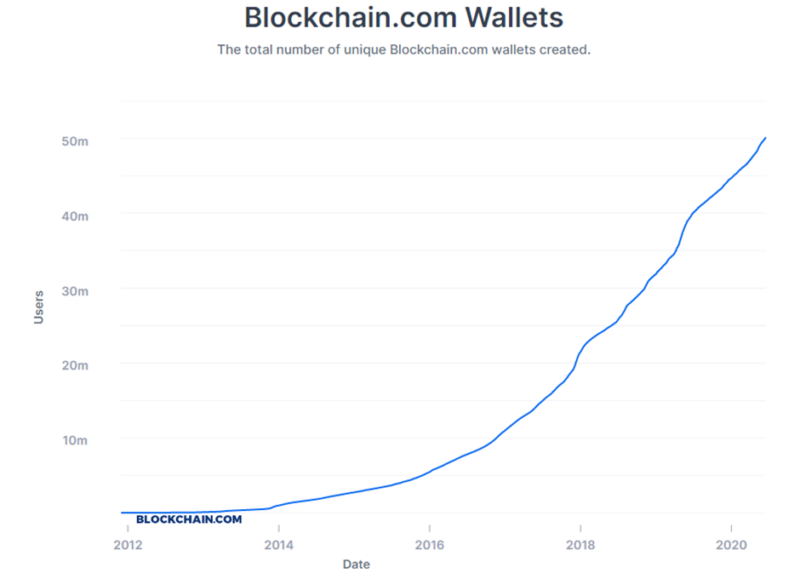

Bitcoin’s fundamentals were further bolstered by its underlying expansion in network addresses, which have just recently surpassed the 50 million landmark. The evidence for exponential adoption is quite conclusive, and continues to grow irrespective of bitcoin’s price. Simply put, the trend for new btc addresses is clearly up and to the right, if not exponential.

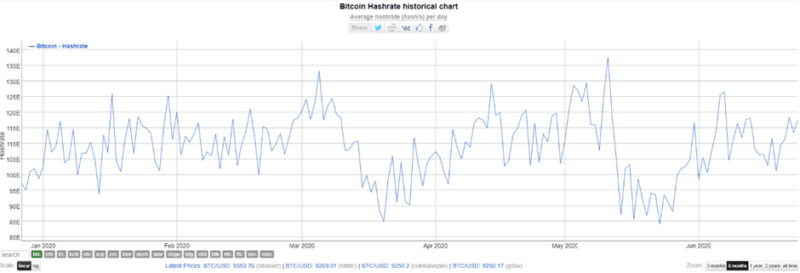

Bitcoin’s supply declines as hashrate remains stable

Meanwhile, just after bitcoin’s major drop in supply due to the halving event, bitcoin’s fundamental network first consolidated and then grew after the capitulation event in March. Briefly, the bitcoin halving slashed miner rewards from 25 bitcoin per day to 12.5 bitcoin per day. This is a hard-coded monetary system within bitcoin which directly affects distribution of coins in an environment were bitcoin is a valuable asset, in part due to its digital scarcity.

Technical data suggests a possible 2020 breakout

From a technical perspective, bitcoin clearly bottomed out at $3,800 earlier this year and is poised to breakout from what is arguably a macro 3-year consolidation period to new all-time highs. Indeed, according to stock-to-flow creator PlanB, bitcoin is well on its way to reaching the $280,000 price-point – which is expected to be in the process of happening as we speak, per his power law modelling.

While it’s more likely that such a target would be achieved sometime after 2020, there’s a technical case to be made for fresh all-time-highs within the next few months, using this particular model. Indeed, from a historical perspective, bitcoin was able to rally past all-time highs within the same year of the halving event in both previous events, none of which were bolstered by today’s fundamentals.

Should bitcoin be able to rally past the $10,500 mark, which has technically held the price down since the mini-bull rally of 2019, then the market could see rapid fireworks to fresh highs as institutional and retail fomo (fear of missing out) set in.

While this is not guaranteed, the fact that such projections are now being touted even by traditional financial conglomerates like Bloomberg – which has now put their reputation (along with their money) behind bitcoin – it’s safe to say that every potential bitcoiner has a duty to at least pay attention to this data.

Industry influencers weigh in on bitcoin’s 2020 price

Tom Lee’s price prediction ($14,000)

The co-founder of the investment strategy company, “Fundstrat Global Advisors,” Tom Lee has become a well-recognised figure in the bitcoin community. He recent put forth a conservative figure for bitcoin’s price in 2020, after having made some wrong calls in the past. In fact, Tom’s measured approach calls for a $14,000 bitcoin in 2020.

He told CNBC:

I think you’re seeing signs that fundamentals are improving, technicals are improving, and now there’s real activity by, essentially, crypto hodlers. […] So, I think […] a 2.5 standard deviation move for bitcoin would take it to $14,000. I’m not saying that’s where it’s going to go, but that’s the magnitude of move that would be a catch-up.

Ronnie Moas price prediction ($50,000)

The founder of Standpoint Research, Ronnie Moas, has often been outspoken about bitcoin’s potential for 2020 all-time highs. Being an avid Twitter user and Wall Street analyst, Moas projected that Bitcoin will reach a price of $50,000 by late 2020. He also believes that the market cap of all cryptocurrencies will burst up to a whopping $2 trillion in the next 10 years. Moas has also compared the wealth proposition of cryptocurrencies to that of the dot-com boom.

PlanB price prediction ($55,000)

Pseudonymous analyst known for the aforementioned stock-to-flow valuation model has suggested a $55,000 price tag. As you can imagine his prediction is based on his very own model, citing that as scarcity grows thanks to the halved block reward, he expected bitcoin’s total market cap to hit 1 trillion in the months following May 2020.

The predicted market value for bitcoin after May 2020 halving is $1trn, which translates in a bitcoin price of $55,000.

Speaking on the price-tag, PlanB has written:

People ask me where all the money needed for $1trn bitcoin market value would come from? My answer: silver, gold, countries with negative interest rate (Europe, Japan, US soon), countries with predatory governments (Venezuela, China, Iran, Turkey etc), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best performing asset of last 10 yrs.

Putting it all together

Ultimately, there’s no doubt that that 2020 is a big year for not just bitcoin, but for the global economic landscape. Needless to say, nobody can predict the future with 100% accuracy. Then again, while history doesn’t repeat itself, it often rhymes, and bitcoin might be the tuning fork that resonates across time.

Having said that, the role that bitcoin is set to play in this fast-evolving paradigm shift has yet to fully develop, and it will be interesting to note who got it right a few years down the line.