Table of Contents

Countless people have come forward to provide insight into bitcoin’s future price trajectory in the last decade, with some calling for a zero-dollar bitcoin and others expecting prices to soar to over $1 million given enough time. This article will go into a Bitcoin price prediction 2025.

As with all things, most investors are simply shooting price predictions from the hip and are more interested in the coverage and media hype that comes with forecasting bitcoin prices than with the fundamental arguments as to why bitcoin would hit 7-figures.

However, some investors and serious businessmen whose arguments stand up to scrutiny are worth paying attention to.

Chamath Palihapitiya, for example, is the Founder of Social Capital and Co-Owner of the Golden State Warriors. His Bitcoin adventure started with 1-million bitcoin investment back in 2012 (when btc cost $80), and by 2013 he had included Bitcoin in his hedge fund, general fund, private account. At a point, he owned 5% of all Bitcoin in circulation.

Earlier in 2017, Palihapitiya predicted Bitcoin price will reach $100,000 within 4 years, and that it will reach a price of $1 million by 2037. He said:

This thing has the potential to be comparable to the value of gold…This is a fantastic hedge and store of value against autocratic regimes and banking infrastructure that we know is corrosive to how the world needs to work properly.

[swissborgGraph]

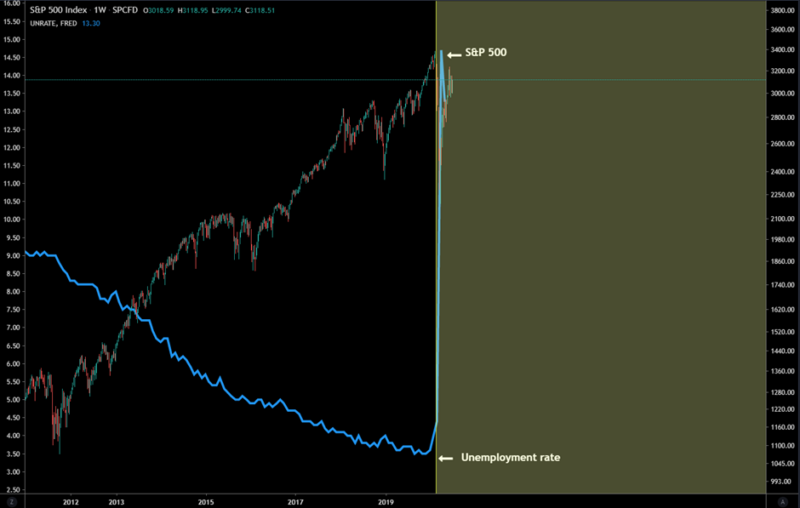

Financial markets are disconnected from the economy

In recent history, Chamath reiterated his claims during a CNBC interview, when he was invited to comment on today’s stock and bond markets. Beating a similar drum beat, he said that there is “no doubt” the economy is disconnected from financial markets, as he pointed to bitcoin as a fundamentally uncorrelated hedge against the prospect of a massive deflationary cycle.

Laying out his argument, Chamath said:

We have completely divorced the economy from the stock and the bond markets, and the Fed has been the principal agent of that obfuscation.

While these comments are not directly linked to bitcoin, Chamath is referring to macro movements in various sections of the US economy that culminate in a convincing argument for bitcoin to appreciate within the next couple of years.

For example, the entrepreneur alluded to the fact that inflating stocks does not help your average Joe, but largely serves to widen income disparities to new levels as corporations gain access to easy money.

He continued:

Asset inflation does not solve income disparity. It actually doesn’t solve full employment. It doesn’t do any of the things we need it to do for it to be a robust economy. What it does is it allows people who play in the financial markets to make money.”

Chamath revises his expectations

Since his comments and calls for lower stock prices, Chamath has just recently adjusted his expectations in light of the fact that central bankers such as the US Federal Reserve have gone beyond what he believed would happen.

[binanceSpot]

Elaborating on his revised thought process, Chamath explained:

The general premise of what I said was probably right, but the timing was way wrong, which is as bad as being wrong, quite honestly. When I said that I had a perception that the Fed will be relatively constrained and operate within normal guard rails. What we’ve seen is that there’s nothing they won’t do to prop up the markets – almost as a symbol of America’s economic resilience – even if that doesn’t necessarily map onto how the economy actually works anymore or how we would measure success.

While Chamath does not directly address the implications of central bank actions for bitcoin, he alludes to the fact that bitcoin is an asymmetric bet or “insurance money” if and when the system collapses.

In fact, his thesis on both the global economic climate and bitcoin are arguably complimentary, in that he expects that eventually, fundamental economic factors would result in a disproportionate amount of capital being deployed into the burgeoning $200 billion digital currency.

From aggregation to decentralisation

Similarly, the billionaire investor also shared his thoughts on the current tech cycle, which has already reached “peak aggregation” in his view. This is to say that everything is more or less centralised. According to Chamath, this centralisation will change within the next 5 to 10 years.

Referring to the economic pendulum that traverses between aggregation and fragmentation, Chamath said:

The product development cycles on the internet tend to move in a pendulum. In economic cycles, the pendulum is between labour and capital. On the internet, the product innovation pendulum is between highly aggregated and highly fragmented. Right now we’re in a very aggregated part of the cycle, but it will break apart because consumers get tired of the Swiss army knife.

He goes on to talk about how the development process has become much smoother and applications are now able to easily ‘talk’ to each other and work together harmoniously. In his view, this would spur development of smaller companies which will look to innovate more locally in light of current events highlighting an incoming wave of decentralisation.

This prospect is further bolstered by geo-political tensions between the US and China, as well as a shift in legal incentives that would favour localism over globalism. Paradoxically, bitcoin’s relevance in such times could be all the more pertinent as it transitions into a hedge against several systems competing in a race to the bottom.

Putting it all together

When seen in unison, it’s clear that Chamath has laid out an eloquent and holistic narrative wherein a lot of moving parts come together. And while it isn’t emphasized so much, a third-party observer can see how bitcoin fits into this narrative simply from a financial point of view (discounting bitcoin’s tech).

Indeed, if stock market and fiat currency valuations are thrown out the window through money debasement, and decentralised development cycles become the norm, the case for bitcoin both to service resources and to act as a deflationary hedge becomes even stronger.

Having said that, the expectation for a $100,000 bitcoin within the next few years just after the halving is still there – otherwise why own the digital asset?

While Chamath’s timing may be off (projection deadline by 2021), a $100,000-price target by 2025 is actually considered conservative by some in the bitcoin space.

[swissborgBuy]

As with most things, one ought to judge by a person’s actions and not by his words. And to this day, Chamath remains a bitcoin hodler, lending credence to the fact that his optimism about the cryptocurrency’s future outweighs his “hope” that it will go to zero.