Table of Contents

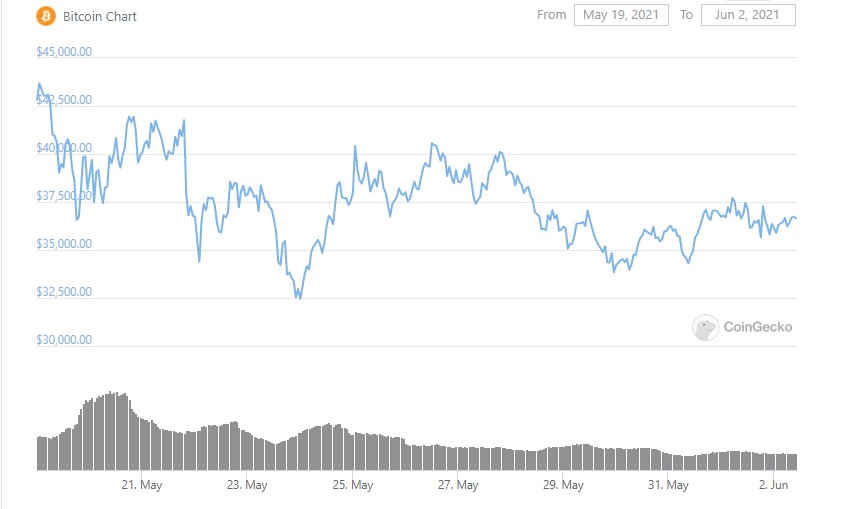

The month of May was more challenging for BTC than the last 10 years, bringing the price of the flagship crypto asset close to $30,000. According to reports, an analyst with JP Morgan has predicted that a further decline in the price of Bitcoin can be expected for the short-term, however, in the long run, the largest digital asset can be seen at a $145,000 price mark.

Bitcoin is the top cryptocurrency in the market and has been known to retain its position despite the price fluctuations observed now and then. The massive price correction witnessed for BTC nearly two weeks ago did not discourage the long-term investors or Bitcoin Whales (who were reported to accumulate more BTC).

Therefore, Bitcoin is a suitable digital asset to invest in. If you are a first-time investor, looking to purchase Bitcoin then you can use SwissBorg exchange or Kraken exchange, two of the top Bitcoin exchanges.

What to Expect for BTC in the Future?

According to JP Morgan analyst, Nikolaos Panigirtzoglou, the flagship cryptocurrency is anticipated to trade between $24,000 and $36,000 in the mid-term, based on its volatility ratios to gold.

The company sent a note to the clients that stated:

“The fair value for bitcoin based on a volatility ratio of Bitcoin to gold of around x4 would be 1/4th of $145k or $36k. The fair value for Bitcoin based on the current volatility ratio of Bitcoin to gold of around x6 would be 1/6th of $145k or $24k. We thus see a fair value range of $24k to $36k over the medium term,”

However, Panigirtzoglou stated that he still sees Bitcoin as high as $145,000, which is a “theoretical target”, provided the crypto asset can get funds allocated from the investors.

In short, the price of Bitcoin is likely to go as low as $26,000 before a surging momentum can be witnessed for the digital asset.

As per reports shared by strategists last year, young investors are more interested in purchasing Bitcoin while older investors opt for gold. However, the growing prominence of Bitcoin is likely to grab the attention of investors of all age groups.

How Does it Affect the Crypto Enthusiasts and Investors?

People who have been long-term investors in crypto are familiar with the volatility of the market. Several factors can affect the prices of Bitcoin and other cryptocurrencies to rise or drop, which in turn has an impact on crypto enthusiasts and investors.

The recent price correction noticed for Bitcoin has been quite challenging for many BTC investors. Many short-term investors were known to sell their Bitcoin holdings after the price of the crypto asset dropped to nearly $30,000.

People are once again concerned as the comeback of the flagship cryptocurrency to the $40,000 region has been short-lived so far and there is a possibility of further decline in its price. Bitcoin is currently trading at $36,847 (at the time of writing).

Here is a graph of BTC price by CoinGecko, tracing back to the steep price correction observed two weeks ago.

The price of Bitcoin has been volatile recently, however, it is not the first time the market has seen such a shift in its price. This is why, most of the long-term investors held on to the Bitcoin they own, which is a positive indication for novice investors.

Despite the ups and downs in Bitcoin price, it is the top crypto asset and is likely to remain in the position. Therefore, people who have been planning on stepping into the crypto space and buying Bitcoin can use secure exchanges such as SwissBorg or Kraken.

Investors can also ultimately consider Bitcoin trading and use a reliable exchange such as ByBit. Interested parties with not enough time or expertise can also enjoy the benefits of trading as well if they opt for copy-trading and use PrimeXBT Covesting.