- NCPPR fears that real inflation could be twice as high

- This could be critical for large capital holders like Amazon

- NCPPR recommends that Amazon buy Bitcoin for at least 5% of its capital

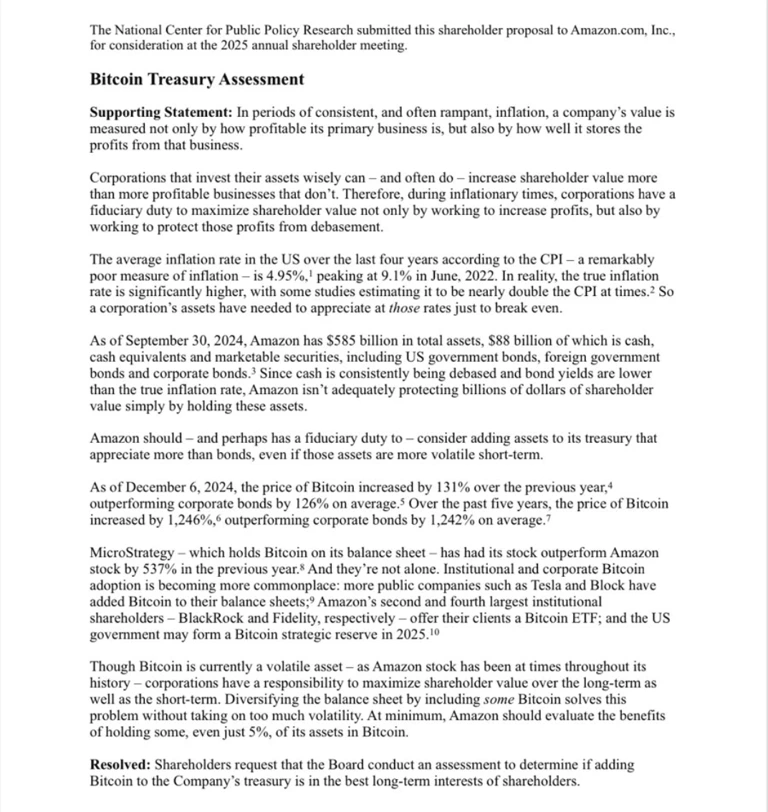

The National Center for Public Policy Research suggests that the inflation rate could be twice as high and have a corresponding impact on big capital and companies like Amazon. NCPPR cites Bitcoin growth statistics over the past few years and suggests this as a deflationary tool.

They recommend that Amazon purchase Bitcoin for at least 5% of its capital, thereby diversifying risk, and Amazon is going to consider this among its shareholders in 2025.

More About the NCPPR Proposal

The National Center for Public Policy Research is a think tank based in Washington, D.C., that advocates for free markets by researching the effectiveness of appropriate approaches and policies.

They have proposed that Amazon Corp consider a risk diversification option, arguing for a Bitcoin corporate treasury strategy to be considered at the April 2025 shareholder meeting.

The details of this proposal are made clear in the letter.

It highlights that the Consumer Price Index on which inflation is based may be a “Remarkably poor measure” and hide the true situation and outlook. They suggest that real inflation could be twice as high and closer to 10% while backing this up with historical data on how inflation in the US has been 4.95% for the past 4 years, peaking at 9.1% in June 2022.

That said, NCPPR put this in the context of Bitcoin’s growth which while showing volatility, has also shown unprecedented growth over the years.

“As of December 6, 2024, the price of Bitcoin increased by 131% over the previous year, outperforming corporate bonds by 126% on average. Over the past five years, the price of Bitcoin increased by 1,246%, outperforming corporate bonds by 1,242% on average.”

They cite companies like MicroStrategy, which has implemented a Bitcoin strategy and has shown a growth rate of 537% in 2024, surpassing Amazon itself in the market. They also remind that Tesla and Block have already included Bitcoin in their reserves, while institutional companies like BlackRock and Fidelity offer Bitcoin ETFs to their clients.

NCPPR advises Amazon to allocate at least 5% of its assets to buying Bitcoin, which they believe would not create significant risk for the company but would avoid much larger potential losses.

In turn, Amazon is probably going to consider this proposal at the 2025 shareholder meeting and make some decisions on it.

Conclusion

More and more companies are looking at Bitcoin not only as a means of capital appreciation but also as a risk diversification and deflationary tool. This is a very interesting position against the background that the crypto market in general, and Bitcoin in particular, inevitably shows volatility and still is an alternative to the seemingly stable USD for many.