Table of Contents

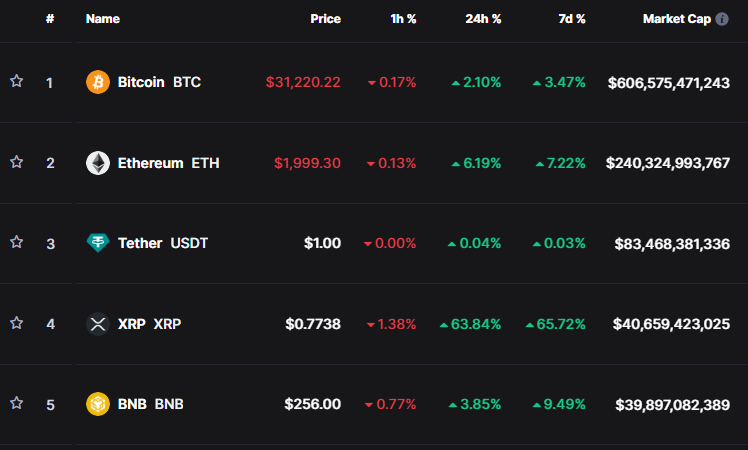

Yesterday’s Ripple victory against the US Securities and Exchange Commission (SEC) lit up the cryptocurrency market in a wave of green and placed XRP back as the fourth-largest cryptocurrency by market cap, now exceeding $40 billion. The news that a U.S. federal judge ruled that Ripple had not violated securities law in selling its XRP token reverberated across the crypto industry. The entire market saw substantial gains in the wake of this decision.

The SEC’s Struggle with Cryptocurrencies

This landmark ruling by Judge Analisa Torres of the New York district court held that Ripple’s crypto-asset should not be considered a security, as the SEC had contended. This decision, the first time a federal court has ruled that a cryptocurrency is not a security, means that such assets should not be subject to the same regulations as stocks and bonds. After the SEC’s campaign against cryptocurrencies, all companies in the sector hailed Ripple’s victory as their own. Major crypto exchanges, including Gemini and Coinbase, that previously delisted XRP, rushed to announce that they would reinstate it.

Judge Torres argued that the SEC had not presented sufficient evidence to prove that XRP was a security. She also stated that the SEC had abused its power by requesting information from Ripple that was unrelated to the XRP investigation.

Ripple’s Battle Since 2020

The legal feud between Ripple and the SEC started in 2020 when the US regulator investigated Ripple for alleged regulatory violations. The SEC’s investigation culminated in a lawsuit against Ripple in December 2020, alleging that the company had sold its XRP token as a security without registering it.

Ripple consistently denied violating the law, asserting that XRP was not a security. The SEC’s refusal to accept this led to the court battle that ended two and a half years later in Ripple’s favor. The ruling represents a setback for the SEC and its chair, Gary Gensler, who has already announced that the SEC will appeal the verdict.

SEC Faces Similar Battles

Following this defeat, the SEC faced similar situations with various cryptocurrencies and tokens labeled “securities.” Last June, the SEC sued Binance and its CEO, Changpeng Zhao, for allegedly violating US securities laws. The regulator also identified BNB, SOL, ADA, MATIC, SAND, MANA, and ALGO as securities.

Ripple’s Sweet Moment

Ripple’s victory against the SEC comes at an exciting time for the company. Despite the devaluation of its token due to the SEC’s accusations, Ripple has continued to develop new products. The company recently launched a platform for CBDCs (Central Bank Digital Currencies) and stablecoins. Ripple is working with the Hong Kong Monetary Authority (HKMA) on a real estate tokenization solution for the inaugural e-HKD pilot.

Ripple’s CEO, Brad Garlinghouse, expressed his optimism on Twitter.

We said in Dec 2020 that we were on the right side of the law, and will be on the right side of history. Thankful to everyone who helped us get to today’s decision – one that is for all crypto innovation in the US. More to come.

— Brad Garlinghouse (@bgarlinghouse) July 13, 2023

Stuart Alderoty, Ripple’s Chief Legal Officer, also declared on Twitter.

A huge win today – as a matter of law – XRP is not a security. Also a matter of law – sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions – to developers, to charities, to employees are not securities.

— Stuart Alderoty (@s_alderoty) July 13, 2023

Implications for the Crypto Industry

The impact of this verdict extends beyond Ripple, indicating a potential turning point in the broader regulation of cryptocurrencies. Given that the SEC has several ongoing cases against other cryptocurrencies, this ruling could set a precedent that influences the outcomes of future claims.

This victory offers the crypto industry a ray of hope, as it could lead to a re-evaluation of existing and proposed regulatory frameworks for cryptocurrencies. The SEC’s defeat in the case will likely force it to re-evaluate its strategy in regulating cryptocurrencies, particularly given the criticism it has received from crypto businesses, supporters, and legal experts.

XRP’s Soaring Value

In the wake of this decision, XRP’s value increased by over 80%, regaining its position as the world’s fourth-largest cryptocurrency by market capitalization. The regulatory uncertainty that had previously kept XRP away from major cryptocurrency markets seemed to have evaporated, as evidenced by several leading exchanges rushing to reinstate the token.

Ripple’s Ongoing Innovations

Despite the regulatory challenges, Ripple continues to innovate and expand its offerings. Recently, the company announced a partnership with the Hong Kong Monetary Authority (HKMA) to demonstrate a solution for tokenizing real estate assets. This pilot project of e-HKD, the first of its kind, could potentially revolutionize how assets are bought, sold, and managed by enabling users to tokenize real estate and use it as collateral for loans.

Ripple’s ongoing legal saga with the SEC has not only tested the company’s resilience but also underscored the need for clear regulatory guidelines for cryptocurrencies. As the dust settles on this landmark ruling, the crypto industry will likely look to the future with renewed optimism.

How to Trade Bitcoin (BTC)?

To understand the basics of Bitcoin trading, you can read our How To Trade Bitcoin Guide. It can prove helpful for traders who are just getting started with Bitcoin trading. You can also check out our list of top Bitcoin Exchanges To Trade With.

PrimeXBT Covesting: Trade Hassel Free

Sign-up on PrimeXBT today to trade Bitcoin hassle-free. You can copy experienced traders and access hundreds of different strategies on the platform! Don’t forget to claim your 25% bonus by using the promo code “bitcoinsensus50” when you sign-up with our link PrimeXBT Covesting