Table of Contents

US Entities Reduce Bitcoin Holdings as Asian Traders Increase Their Stakes

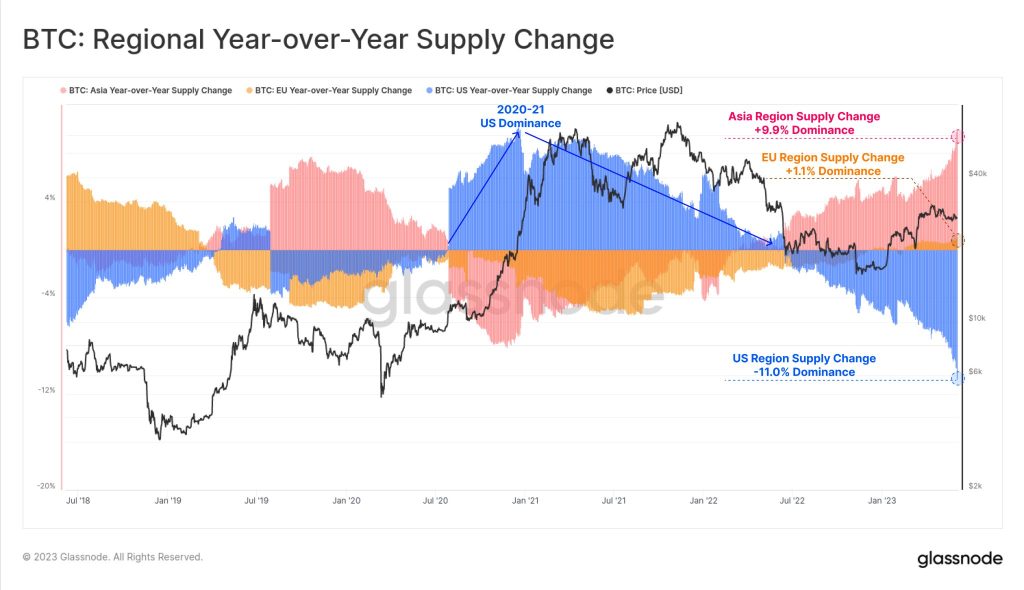

Over the past two years, a significant shift in the dominance of Bitcoin’s supply has emerged, showcasing a departure from the patterns observed during the 2020-21 bull cycle. US entities have experienced an 11% decline in their Bitcoin (BTC) holdings since June 2022, while investors active during Asian trading hours have acquired 9.9% more BTC.

You can trade Bitcoin with leverage on Bybit. By using our link, you can get up to a $30,030 bonus. (Bonus may vary based on deposit amount)

Stablecoin Landscape Reflects Changing Tides

The stablecoin market also reveals notable transformations. Tether (USDT) has reached new all-time highs in supply, while USDC and BUSD have dipped to multi-year lows. This shift indicates a change in the involvement of US capital in digital assets, potentially influenced by regulatory pressures and the absence of interest-bearing features in stablecoins.

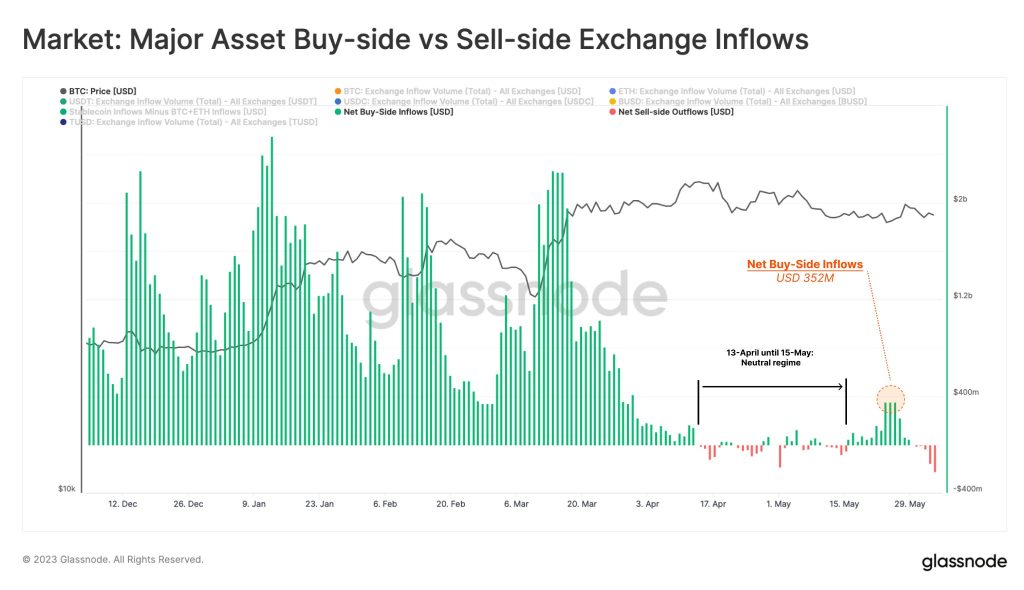

On-Chain Flows Indicate Weaker Demand and Capital Rotation

Analyzing on-chain flows, it becomes evident that demand has weakened since April. In the first quarter, stablecoin inflows significantly offset BTC and ETH inflows, indicating a cautious market sentiment. However, the current market correction reveals larger BTC and ETH inflows (presumed sell-side) relative to stablecoins, suggesting a shift in capital allocation and a migration of liquidity towards lower-risk digital assets.

Net Capital Rotation and Liquidity Migration in Digital Assets

Multiple undercurrents are at play, signaling a broader trend of net capital rotation and liquidity migration within the digital asset space. The reduction of BTC holdings by US entities, coupled with the surge in Asian traders’ involvement, points to changing dynamics in global Bitcoin ownership. Simultaneously, the flourishing supply of stablecoins and their varying levels of popularity indicate the evolving preferences of market participants.

Regulatory Pressures and Risk Perception Impacting Market Dynamics

The increased regulatory scrutiny faced by stablecoins in the US, combined with the non-interest-bearing nature of these assets, suggests a reduced engagement of US capital in digital assets. As market participants reassess risk perception and regulatory landscapes, they seek out alternative digital assets that offer potentially lower risks or greater stability.

Conclusion

The past two years have witnessed a dramatic shift in the dominance of Bitcoin supply, with US entities reducing their holdings while Asian traders increase their stakes. The stablecoin landscape reflects changing tides, as USDT reaches new heights while USDC and BUSD experience declines. On-chain flows indicate weaker demand and a shift in capital allocation, suggesting a net capital rotation and liquidity migration towards lower-risk digital assets. These developments are influenced by regulatory pressures, risk perception, and evolving market dynamics. As the digital asset ecosystem continues to evolve, market participants will navigate these shifting landscapes, seeking opportunities and adjusting their strategies to adapt to the changing realities of the crypto market.

If you are looking to leverage trade Bitcoin up to 100x, sign-up on Bybit today. You can also use this link to claim a bonus on your first deposit.